- Published on

Hormuz Strait: Will Rising Tensions Lead to Closure and Global Economic Impact?

- Authors

- Name

- Juno Ryelie

Hormuz Strait: Will Rising Tensions Lead to Closure and Global Economic Impact?

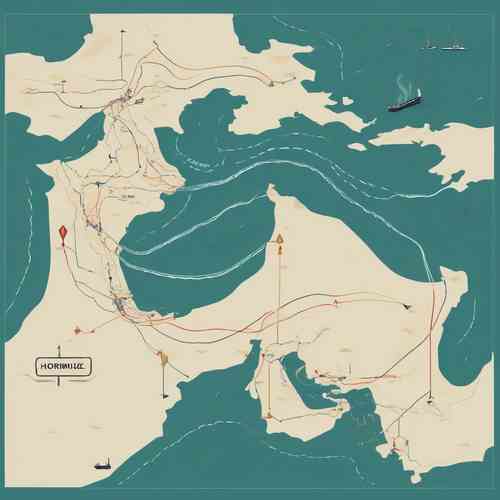

The Strait of Hormuz, a narrow waterway between Iran and Oman, is one of the world's most critical chokepoints for oil and natural gas. Recent escalations in the Middle East raise concerns about potential disruptions to global energy supplies, prompting increased monitoring and strategic realignments in major importing nations.

Quick Context

The Strait of Hormuz connects the Persian Gulf with the Gulf of Oman and the Arabian Sea, serving as a vital artery for global energy markets. Its strategic importance is underscored by the fact that a significant percentage of the world's oil and liquefied natural gas (LNG) passes through it daily. Heightened tensions in the region, particularly between Iran and its adversaries, often lead to speculation about the potential closure of this critical waterway, sending ripples of concern throughout the global economy.

Surprising Fact: India imports about 40% of all its oil and about half of its gas through the Strait of Hormuz.

Key Statistic: The Strait of Hormuz serves as the main route for oil exports from Saudi Arabia, Iran, Iraq, Kuwait, and the UAE, representing a fifth of the world's total oil transit.

What You Need to Know

The current geopolitical landscape is marked by escalating tensions between Iran and Israel. Recent events, including alleged Israeli strikes on Iranian nuclear sites and retaliatory actions, have amplified concerns about regional stability. Amid these developments, Iran has, at times, threatened to close the Strait of Hormuz, a move that could have far-reaching consequences for global energy supplies and prices.

Core Development: India's Response to Regional Volatility

In response to the volatility, India, the world’s third-largest oil importer and consumer, has been proactively diversifying its sources of crude oil. Recent data indicates a significant increase in oil imports from Russia and the United States, surpassing the combined volumes from traditional Middle Eastern suppliers like Saudi Arabia and Iraq. This strategic shift aims to mitigate the impact of potential disruptions in the Middle East.

Core Development: Potential Closure Scenarios

While Iranian hardliners have threatened to close the Strait of Hormuz and state media have warned of oil spiking to USD 400 per barrel, not all analysts believe a full blockade is probable. Kpler, a global trade analytics firm, assigns a very low probability to a complete closure, citing strong disincentives for Iran itself. A self-imposed blockade would be counterproductive, given Iran's reliance on the Strait for its own oil exports via Kharg Island, which handles 96% of its exports.

Core Development: Geopolitical and Economic Disincentives

Further discouraging a potential closure is the impact it would have on China, Iran's largest oil customer, which imports 47% of its seaborne crude from the Middle East Gulf. Moreover, Tehran has been working to rebuild ties with key regional actors like Saudi Arabia and the UAE, both of which rely heavily on the Strait for exports. Sabotaging these flows would risk unraveling these diplomatic gains. Any such move would also likely provoke international military retaliation, particularly from the US and its allies.

Why This Matters (Implications)

The Strait of Hormuz is of paramount importance to the global economy. Its closure, even temporarily, could trigger a significant spike in oil prices, impacting industries ranging from transportation and manufacturing to agriculture and energy production. For countries heavily reliant on Middle Eastern oil, like India, the implications could include increased inflation, higher import bills, and potential disruptions to economic growth. The strategic importance of the Strait also underscores the interconnectedness of geopolitics and economics, demonstrating how regional tensions can quickly translate into global economic consequences.

What Experts Are Saying

According to Sumit Ritolia, Lead Research Analyst, Refining & Modeling at Kpler, shipowners are hesitant to send empty tankers into the Gulf, suggesting a potential tightening of MEG supplies in the near term. Ritolia notes that India's import strategy has evolved significantly over the past two years, with Russian oil being logistically detached from Hormuz and Indian refiners building refining and payment flexibility. He concludes that if conflict deepens or there is any short-term disruption in Hormuz, Russian barrels will rise in share, offering both physical availability and pricing relief. India may also pivot harder toward the US, Nigeria, Angola, and Brazil, albeit at higher freight costs.

Potential Impact & Future Outlook

In the short term, heightened vigilance and strategic realignment of supply chains are expected to continue among major oil-importing nations. India's diversification efforts, including increased reliance on Russian and US oil, are likely to persist as a hedge against potential disruptions. Should a closure of the Strait of Hormuz occur, even for a brief period, the immediate impact would be a surge in global oil prices, potentially leading to inflationary pressures and economic uncertainty.

Longer-term, the geopolitical dynamics surrounding the Strait of Hormuz are likely to remain a key factor in shaping global energy policy. Increased investment in alternative energy sources, further diversification of oil supplies, and the development of strategic oil reserves are all potential strategies that countries may pursue to mitigate the risks associated with this critical chokepoint. The future outlook depends heavily on de-escalation efforts in the Middle East and the ability of key players to maintain stability in the region.

The Strait of Hormuz remains a critical vulnerability in the global energy landscape. As tensions persist, proactive measures to diversify energy sources and strengthen strategic reserves are crucial to minimizing potential economic fallout. Stay informed and follow developments in the region closely to understand the evolving risks and opportunities.

Tags: #HormuzStrait #OilPrices #Geopolitics